Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

What is the Difference Between a Lien and a Levy?

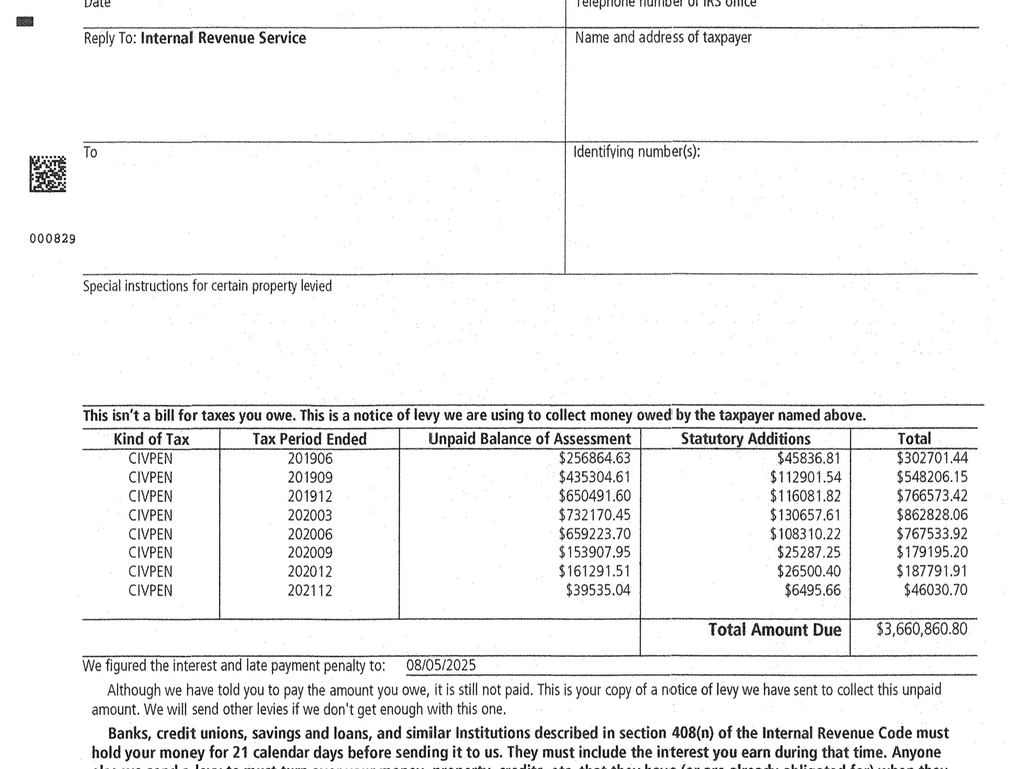

A levy is a legal seizure of your property to satisfy a tax debt. Levies are different from liens. A lien is a legal claim against your property to secure payment of your tax debt, while a levy actually takes the property to satisfy the tax debt. A federal tax lien comes into being when the IRS assesses a tax against you and sends you a bill that y

What is the Difference Between a Lien and a Levy?

A levy is a legal seizure of your property to satisfy a tax debt. Levies are different from liens. A lien is a legal claim against your property to secure payment of your tax debt, while a levy actually takes the property to satisfy the tax debt. A federal tax lien comes into being when the IRS assesses a tax against you and sends you a bill that y

Our Portal: Advanta Tax LLC

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.